Updating Your ABN

It can be an easy oversight to forget to update the ABN details in the Australian Business Register (ABR) when your business situation or circumstances change.

A businesses ABN details are used by emergency services and government agencies to help identify businesses in affected areas that might need help or support. If ABN details are out of date a business risks missing out on important assistance, updates, or opportunities such as grants.

Updating ABN details will ensure:

- The right people have the right permissions to act on behalf of a business.

- Government agencies have current information – for example, if

- You are ready for new government services when they become available.

To make sure a business does not miss out on receiving important information, update your ABN details such as:

- Authorised contacts.

- The organisation’s physical location (not the Tax Agent or BAS Agents’ address).

- Postal address.

- Email address.

- Phone number.

Take time to have a conversation with your BAS Agent or Bookkeeper regarding your business structure. Find out if your existing entities have more than one ABN, and whether these are still in operation.

Should you find that they no longer operating be sure to cancel the ABN. Additionally, if the business structure has changed and the ABN in question is no longer valid, then cancel the ABN for the old structure and apply for a new ABN.

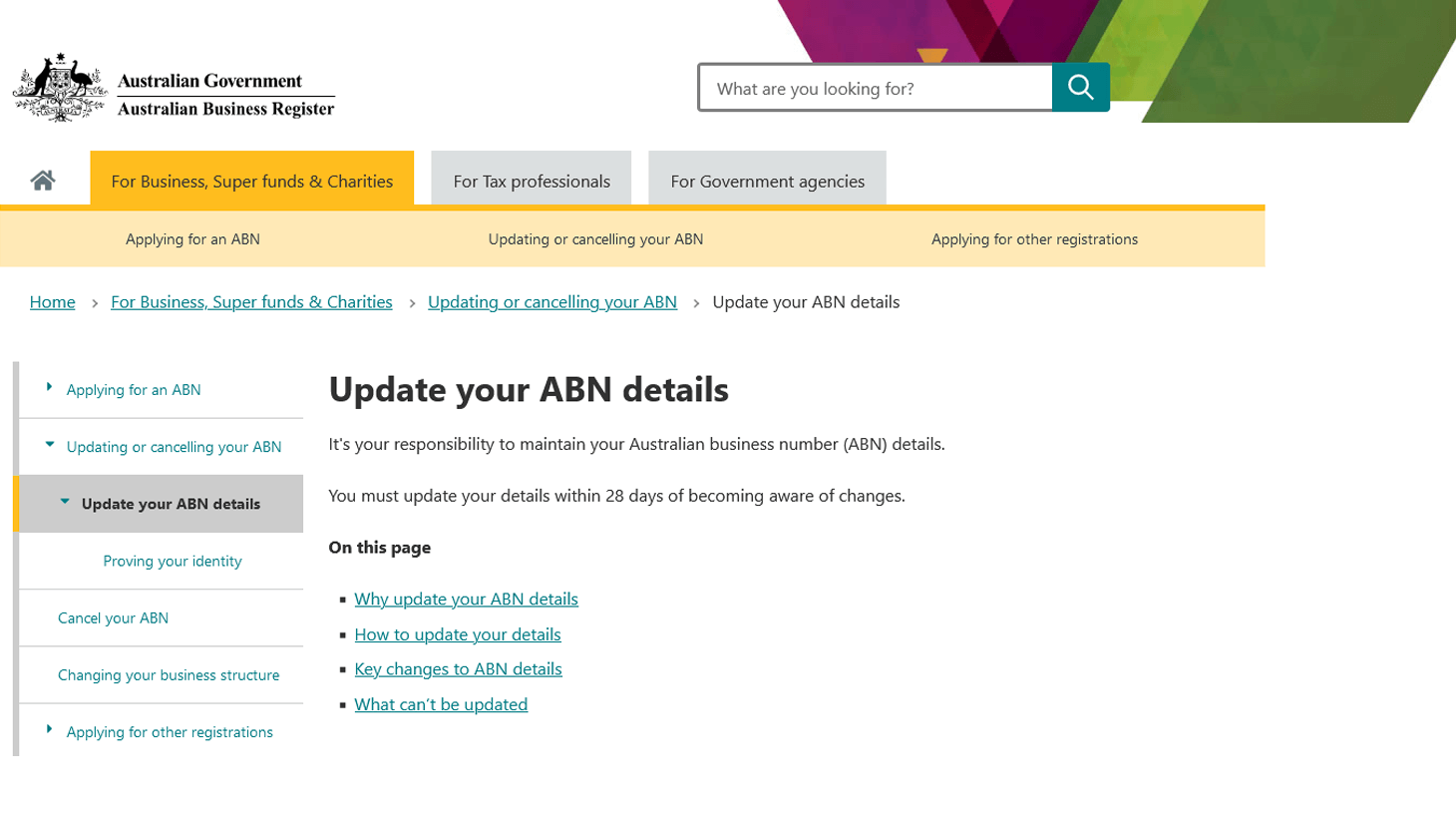

What Are The Obligations as an ABN Holder?

If you hold an ABN, legally you must notify the ABR within 28 days of any changes, such as changes to your name, address, and other contact details.

If the ABR writes to you requesting information about your ABN entitlement or to confirm your identity or other details in the register, you must comply with this request.

If you are no longer in business you need to request to have your ABN registration cancelled. You should do this once you have met all of your tax obligations.

How to Update Your ABN Details

The fastest way to update your details is through ABR online services. Log in using myGovID and Relationship Authorisation Manager (RAM).

• Access the ABR information – ABR Website – Update your ABN information

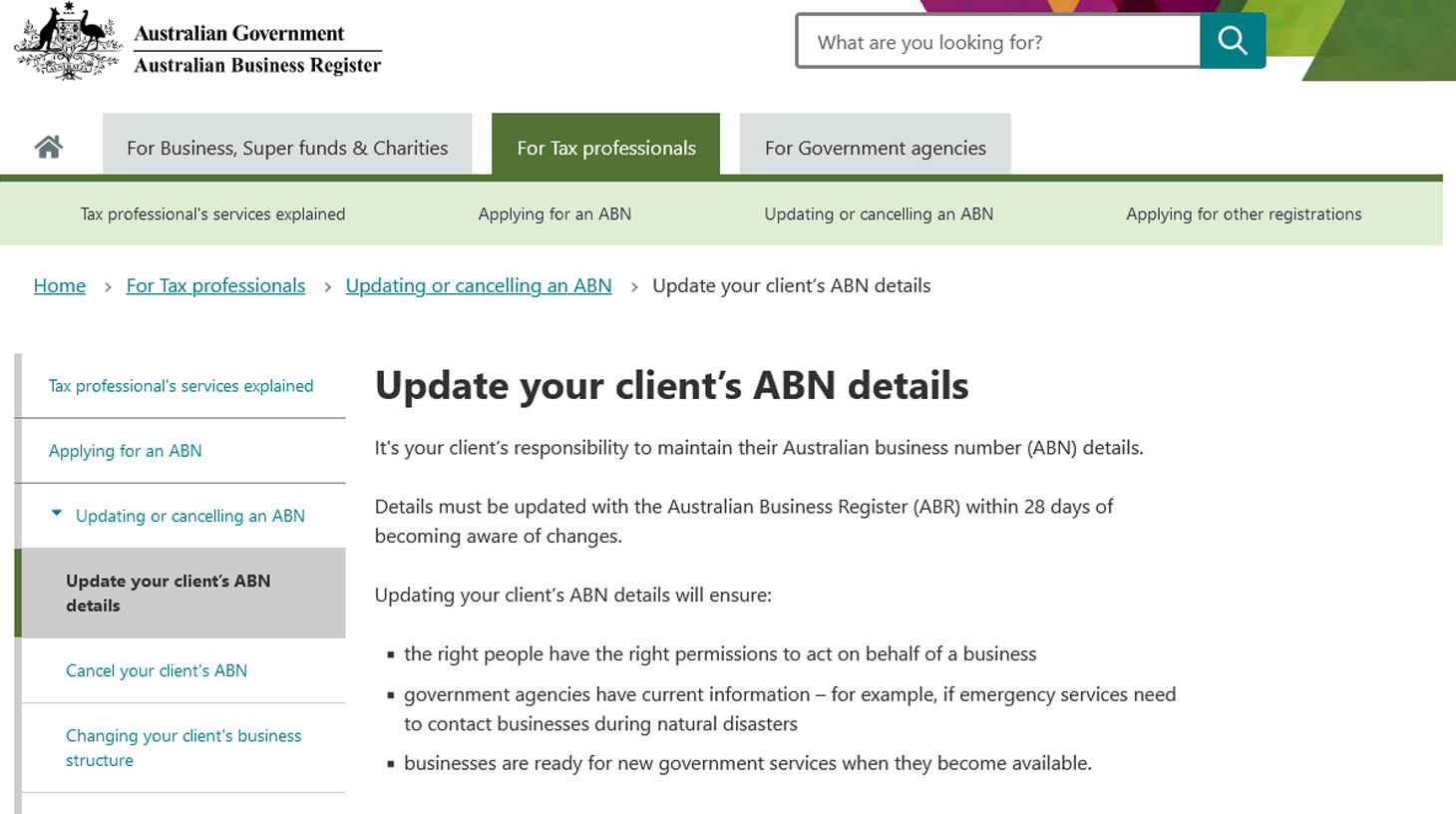

Would You Prefer Your BAS Agents To Do This?

- The fastest way for a BAS Agents to update their client’s details is online through the ABR’s Tax professional’s services using myGovID.

- All changes made to a client’s ABN will take effect immediately if done through the Tax professionals services.

- For more information see ATO – Update your ABN details

Employee or Independent Contractor?

How Quickly Does Large Business Pay Small Business?

The recent High Court’s approach provides greater certainty for businesses who have properly recorded their independent contractor relationships in written contracts that accurately reflect the nature of the relationship.

If work has been undertaken on the basis of a comprehensive set of written terms, it’s those terms which will be the basis for determining whether or not you’re an employee or an independent contractor, not the reality of your working arrangements. Source: High Court rules on whether you are an employee or an independent contractor – ABC News

- The engagement contract is the most important document to protect employers: it must comprehensively outline the terms of engagement. If key aspects of the relationship are not regulated by the agreement, this could allow a contractor to challenge the contract and a court to examine the conduct of the parties.

- The contract should facilitate that ultimately the worker performing the work, even though contractor arrangement, is able to be paid at least the minimum wage (this is increasingly becoming law).

A review and update of contractor agreements would be wise to implement to ensure the legal rights, duties and obligations created between the parties are consistent with the relationship of an independent contractor and principal.

The Detail

The High Court has set a new direction for determining the vexed issue of whether an employment relationship or an independent contractor relationship exists in its landmark decisions of CFMMEU v the Personnel Contracting [2022] HCA 1 (Personnel Contracting) and ZG Operations Pty Ltd v Jamsek & Ors [2022] HCA 2 (Jamsek).

The two rulings by the High Court are significant because they emphasise the importance of written contracts. The High Court has reinforced businesses’ ability to engage workers as independent contractors in a ruling that creates major barriers for sham contract claims and lends support to Uber and Deliveroo’s arguments their drivers are not employees entitled to minimum wages and conditions.

ZG Operations Pty Ltd v Jamsek & Ors [2022] HCA 2 (Jamsek)

In a unanimous decision handed down Wednesday, the High Court held two truck drivers who worked full-time for a lighting company for almost 40 years but under a partnership arrangement were not employees entitled to minimum pay and conditions, including superannuation and annual leave.

It held that the parties had comprehensively committed the terms of their relationship to a written contract and the characterisation of whether that relationship is one of employment or otherwise must proceed by the reference to the rights and obligations of the parties under that contract.

The contracting parties were the partnership and the freight company and it was no place of the Court to determine the legal status of the relationship by reference to the substance and reality of the relationship based upon a review of the conduct of the parties over the 30 years.

CFMMEU v the Personnel Contracting [2022] HCA 1 (Personnel Contracting)

In Personnel Contracting the High Court applied the same reasoning to reverse the decision of the Full Federal Court and held that a 22 year old British backpacker on a working holiday visa was an employee of a labour hire company which offered his services to its clients on construction sites.

The backpacker and labour hire company entered into an agreement styled as an independent contractor agreement. The labour hire company had entered into a further agreement with its builder client to provide the backpacker’s services on site. There was no contract between the backpacker and the builder.

We are yet to hear from Fair Work on the matter. They are reviewing the information on their webpage in light of these decisions and will update the information if required.